For most growing businesses, payroll and statutory compliance don’t fail because teams don’t care. They fail because the systems behind them are disconnected.

Payroll is often managed in one tool, compliance tracking in another, approvals over email, and final reports in spreadsheets. Each month becomes a race against deadlines, rule changes, and manual checks. Over time, this creates risk missed deductions, inconsistent records, and unnecessary stress during audits.

This is where Odoo HRM stands out. Instead of treating payroll and statutory compliance as separate tasks, it brings them into one connected workflow. The result is not just efficiency, but clarity. HR, finance, and leadership can finally see the full picture without jumping between systems.

This article explains how that works in practice, what problems it solves, and when it makes sense for your organization.

Quick summary for decision-makers

If your payroll and statutory compliance processes rely on multiple tools, spreadsheets, or manual approvals, errors and delays are almost inevitable. Odoo HRM helps unify payroll processing, compliance calculations, approvals, and reporting into a single workflow reducing risk, improving traceability, and making monthly payroll more predictable when correctly configured with localization and governance in place.

Why payroll and statutory compliance break down in real businesses

Most payroll issues don’t start with calculation errors. They start with fragmentation.

HR teams manage employee records. Finance teams track payments and liabilities. Compliance requirements change quietly in the background. When these pieces don’t talk to each other, even small gaps can snowball into bigger problems.

Common challenges teams face

- Manual updates to statutory rules and deductions

- Separate approval processes for payroll and compliance-related payments

- Limited visibility into who approved what, and when

- Reports that need reworking every month to meet audit or review requirements

Over time, teams rely on workarounds. Spreadsheets fill the gaps. Emails replace structured approvals. Critical knowledge sits with one or two people. This might work at a small scale, but it doesn’t hold up as the organization grows.

The hidden business risk of disconnected systems

Disconnected payroll and compliance systems increase exposure not through dramatic failures, but through small inconsistencies that accumulate. Leadership often only notices when there is an external review, a delayed filing, or a compliance query that takes days to resolve.

What businesses need is not another standalone tool, but a single, controlled flow that connects payroll data, compliance logic, approvals, and reporting.

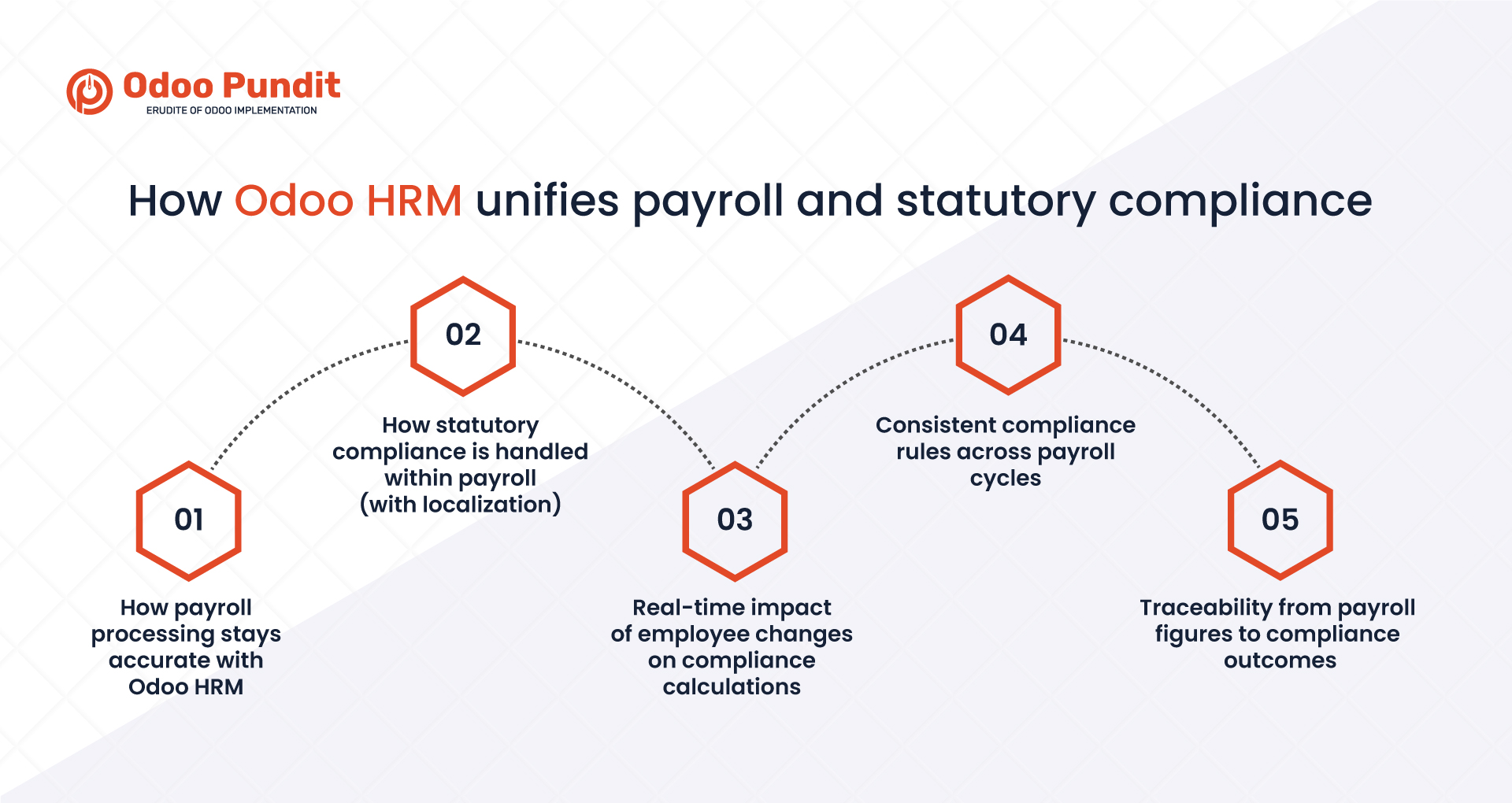

How Odoo HRM unifies payroll and statutory compliance

How Odoo HRM unifies payroll and statutory compliance

At its core, Odoo HRM treats payroll and statutory compliance as parts of the same controlled workflow rather than parallel, disconnected tasks. Employee records, contracts, salary structures, statutory deductions, and approval routes are managed in a single system. This reduces duplication and ensures that changes in one area flow into the others once the system is properly configured.

How payroll processing stays accurate with Odoo HRM

Payroll starts with structured employee and contract records. Compensation components, benefits, and deductions are defined using salary rules and applied consistently across payroll cycles. When payroll runs, calculations are handled automatically based on these configured rules.

This reduces the need to manually adjust figures each month. More importantly, statutory deductions are calculated using the same payroll data, which helps avoid the mismatches that often occur when payroll and compliance are handled in separate tools.

How statutory compliance is handled within payroll (with localization)

Statutory requirements are applied within payroll calculations through configured salary rules and localization-specific settings. To ensure accuracy, the relevant payroll localization modules must be installed and configured for the applicable region.

Instead of exporting payroll data to another system for compliance checks, deductions and contributions are processed within the same workflow. Reports generated from payroll are aligned with statutory requirements based on the configured rules and localization in use, reducing last-minute corrections and rework.

Real-time impact of employee changes on compliance calculations

One of the practical advantages of a unified system is how employee changes flow through payroll and compliance together. When an employee’s role, compensation component, or eligibility changes, the impact is reflected across payroll and statutory calculations once the relevant rules are in place.

There is no need to update multiple tools or recheck formulas across systems when payroll and compliance rules are correctly configured. This significantly reduces the risk of outdated or incorrect deductions caused by fragmented data.

Consistent compliance rules across payroll cycles

Statutory compliance often breaks down when rules are applied inconsistently from one payroll cycle to the next. Odoo HRM relies on defined salary structures and deduction rules that remain consistent unless intentionally updated as part of compliance changes or payroll policy updates.

This consistency helps teams maintain continuity across payroll cycles and makes it easier to identify and explain variances in compliance reports.

Traceability from payroll figures to compliance outcomes

Because payroll and statutory compliance are handled within the same workflow, every deduction and contribution can be traced back to its payroll source. Teams can move from a compliance report directly to the underlying payroll data without additional reconciliation work.

This level of traceability is especially valuable during audits, internal reviews, or management discussions where clarity and accountability matter more than speed.

Practical note: Odoo enables payroll compliance through configuration and localization. Ongoing accuracy depends on maintaining localization modules, salary rules, and periodic updates as regulations change.

How approval workflows reduce payroll and compliance errors

One of the most overlooked causes of payroll issues is unclear approval ownership. When approvals happen through email or messaging tools, there is no reliable audit trail.

Odoo HRM replaces this with structured approval workflows.

Multi-level approvals with clear accountability

Payroll drafts can move through predefined approval stages. HR teams review employee-level details, finance teams validate totals and compliance liabilities, and managers provide final approval.

Each step is logged, creating a clear record of who approved what and when. This becomes especially important during audits or internal reviews.

Automation that supports human oversight

Automation handles repetitive tasks such as payroll runs, report generation, and notifications. Decision points remain with people. This balance improves speed without removing control.

Teams spend less time preparing data and more time reviewing it properly.

Managing statutory vendors and external compliance dependencies

Statutory compliance often involves external entities such as regulatory bodies, consultants, or service providers. Managing these relationships outside the payroll system creates gaps.

Centralized vendor tracking within the Odoo ecosystem

Odoo HRM works alongside purchasing and accounting workflows, allowing statutory vendors to be managed within the same ecosystem. Payments, approvals, and records are linked to compliance activities.

This creates a clear audit trail. When questions arise, teams can trace payroll figures, compliance deductions, and vendor payments without cross-referencing multiple systems.

Fewer handoffs, fewer errors

Because payroll data flows directly into compliance-related transactions, there is less re-entry of information. This reduces both manual effort and the risk of mismatches.

A practical payroll-to-compliance workflow in Odoo HRM

To understand the value, it helps to look at a typical monthly cycle.

Employee attendance, salary components, and changes are updated first. Payroll is calculated using predefined rules, and statutory deductions are applied at the same time.

Payroll then moves through approvals. HR reviews employee-level accuracy, finance checks totals and compliance liabilities, and managers provide final sign-off.

Once approved, payslips and compliance reports are generated. These reports are prepared using the same payroll data, making them ready for filing or review.

The key benefit is predictability. Each month follows the same controlled process, with fewer surprises and less manual intervention.

Benefits across teams, not just HR

A unified payroll and compliance system changes how teams work together.

Benefits for HR teams

HR spends less time fixing errors and chasing approvals. Employee questions are easier to answer because data is consistent. Changes in employee status or compensation flow directly into payroll.

Benefits for finance teams

Compliance liabilities are visible earlier in the process, not discovered after payroll is finalized. Reports are reliable and easier to validate during audits.

Benefits for leadership

Risk is reduced through standardization. Processes scale without rebuilding workflows as the organization grows.

When Odoo HRM is the right fit and when it needs more planning

Odoo HRM works well for organizations that want control, transparency, and flexibility in payroll and compliance processes.

It is particularly suitable for growing businesses that have outgrown spreadsheets and disconnected tools. Teams that value clear approvals and audit trails tend to see the strongest benefits.

However, complex compliance environments or unique payroll structures require careful planning. In such cases, working with experienced partners and leveraging Odoo implementation services helps ensure payroll and compliance are configured correctly from the start.

Customization is possible, but it should be purposeful. Thoughtful use of Odoo customization services allows businesses to address specific requirements without overcomplicating core workflows.

Key takeaways

- Payroll and statutory compliance failures usually stem from disconnected systems

- Odoo HRM unifies payroll processing, compliance logic, approvals, and reporting

- Localization and configuration are essential for accurate compliance

- Structured approvals and traceability reduce audit and reporting risk

- The biggest benefit is predictability, not just automation

Final thoughts: simplifying without oversimplifying

Handling payroll and statutory compliance together is not about cutting corners. It’s about reducing unnecessary complexity while keeping the controls that matter.

Odoo HRM achieves this by connecting data, rules, approvals, and reporting into one coherent flow. Teams spend less time managing the process and more time understanding it.

For organizations reviewing their payroll and compliance approach, the real question is not whether automation is needed, but whether the system supports how people actually work. The goal is not just to run payroll but to trust it.

Curious whether Odoo HRM can simplify payroll and compliance in your organization?

Start by reviewing where payroll errors and compliance gaps tend to surface today.

FAQs

Yes. Odoo HRM supports integrated payroll and compliance workflows when salary rules and localization modules are correctly configured.

No. Odoo provides localization modules, but organizations must maintain and update configurations as regulations change.

Yes. It is particularly effective for organizations moving away from spreadsheets and disconnected payroll tools.

Yes. Approval stages can be configured to match HR, finance, and management review processes.