Running a Business in India Isn’t Easy-Compliance Makes It Harder

Ask any small or mid-sized business owner in India about their biggest struggle, and chances are, compliance will be in the top three.

You’re tracking purchases in Excel, doing accounts in Tally, and relying on WhatsApp to manage field teams. Meanwhile, GST deadlines are looming, e-invoicing is now mandatory, and your accountant just flagged missing TDS entries.

It’s not that Indian businesses don’t want to stay compliant—they do. But the system feels fragmented, especially when you're growing or working across states.

That’s where Odoo comes in. Unlike traditional software, Odoo adapts to your workflow, not the other way around. And when localized properly, it can do far more than just help you meet tax requirements; it can organize your entire business.

Why Indian Businesses Need More Than Just Software

India is a unique market. A startup in Bengaluru, a garment exporter in Surat, and a wholesale trader in Indore each operate differently, but all face similar challenges:

- Tax laws change frequently: GST rules, TDS applicability, invoicing formats, they all shift every few months.

- Multiple states, different rules: One business might operate under several GSTINs with branch-wise compliance needs.

- Language and process diversity: Some team members prefer working in Hindi or local languages, while clients expect English invoices and USD pricing.

- Tool overload: Many companies use five or more tools to manage day-to-day operations, none of which talk to each other.

That’s exactly why Indian businesses need a platform that’s not just ERP, but ERP built for India.

How Odoo Handles Indian Compliance with Ease

How Odoo Handles Indian Compliance with Ease

Over the years, Odoo has evolved from being a global ERP to a truly localizable platform. For Indian businesses, this means prebuilt tools and workflows for managing taxation, operations, and finances, without jumping between systems.

Here’s how Odoo helps you stay compliant and in control:

GST: Fully Built In

GST compliance is built into Odoo’s core Indian modules:

- Automatically calculates CGST, SGST, and IGST based on location and product type.

- Supports HSN/SAC codes for service and goods classification.

- Generates clean, export-ready reports for GSTR-1 and GSTR-3B.

- Validates GSTINs during invoice creation—no more surprises at filing time.

You no longer need to worry if numbers will match at month-end. Odoo tracks and compiles them in real time.

E-Invoicing & E-Way Bills Without Manual Entry

If your business turnover exceeds ₹5 crore, you’re already required to issue e-invoices. Odoo handles that too.

With direct API integration to the government NIC portal:

- E-invoices are generated automatically as soon as you validate an invoice.

- E-way bills are created right from the same screen—no switching tabs.

- Reduces the chance of manual errors or duplication.

Whether you're shipping goods across cities or serving clients from multiple locations, Odoo keeps your transport and tax documentation tight.

TDS & TCS Calculations That Actually Work

Service providers, freelancers, and even retailers often overlook TDS until it becomes a problem. With Odoo:

- TDS is auto-calculated based on vendor type and service.

- Applies correct deduction sections like 194C, 194J, etc.

- Generates ready-to-upload TDS reports for filings.

It saves hours every month, especially for businesses dealing with frequent contractors, agencies, or professional services.

Accounting That Fits Indian Books

Many businesses still use Tally because it’s “made for India.” But Odoo comes with a ready-to-use Indian chart of accounts, and adds a lot more:

- Accurate journal entries and ledgers

- Multi-branch, multi-location tracking

- Configurable closing entries and reconciliation tools

- Real-time financial dashboards

You get the power of a full ERP with the familiarity your accountant expects.

Banking + UPI = Smooth Reconciliation

Indian banks like ICICI, HDFC, SBI, and Axis are supported for statement imports.

While UPI auto-sync isn't common yet, Odoo lets you:

- Add UPI or QR-based payments manually and link them to invoices

- Maintain cash and digital payment ledgers easily

- Reconcile accounts without spreadsheet juggling

For retail, D2C, or service-based businesses, this means clear visibility of incoming cash, even when it’s collected via phone, QR, or field sales.

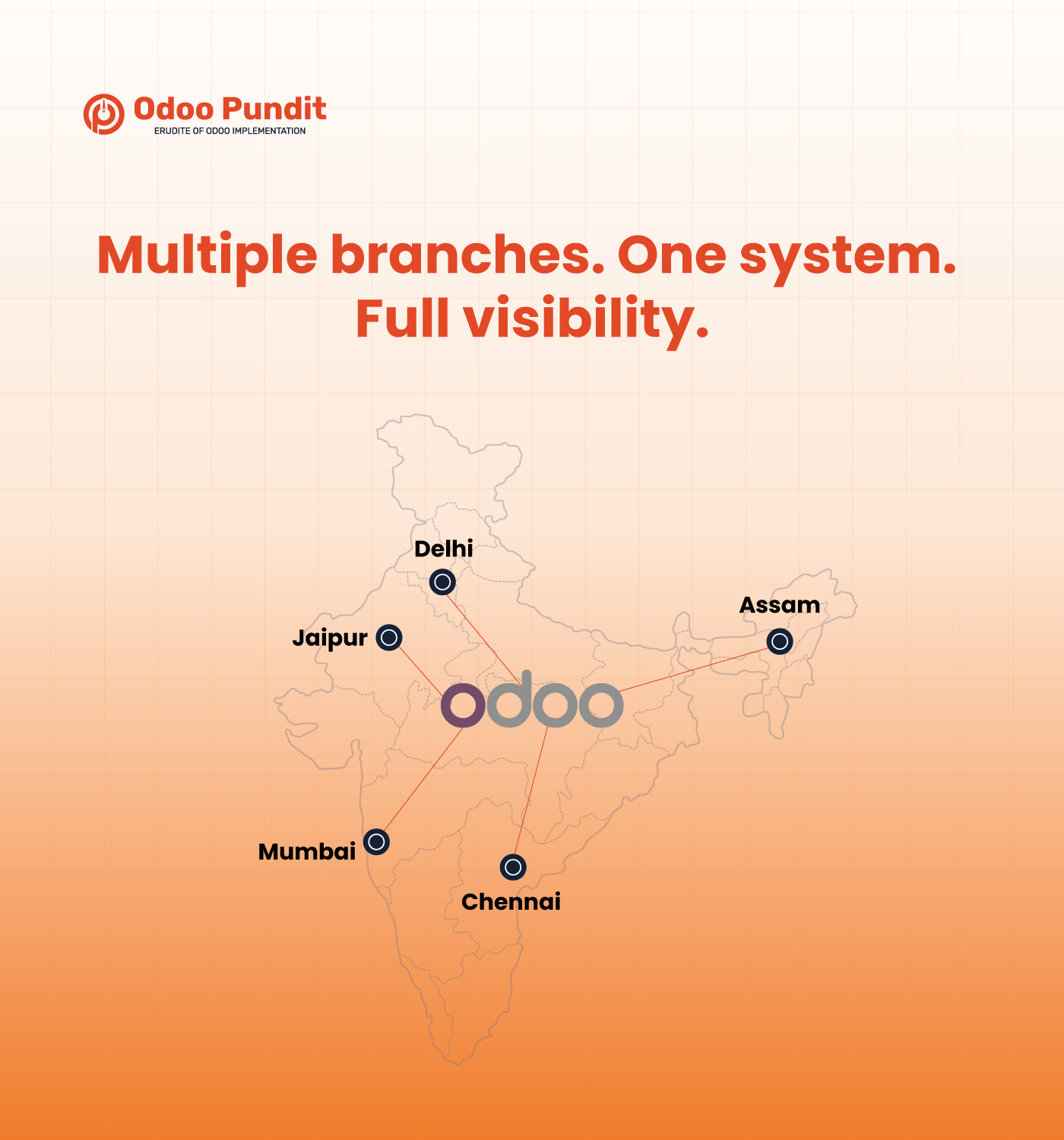

/inag Multiple branches. One system. Full visibility.

/inag Multiple branches. One system. Full visibility.

Built for Multi-State, Multi-GSTIN Businesses

Have branches in Mumbai, Hyderabad, and Jaipur? Each with its own GSTIN?

Odoo can:

- Maintain separate GST returns for each branch

- Segregate inventory, invoices, and payments by location

- Let you give access by user, role, and site

It’s one centralized system for your entire business—even if you operate like five different ones.

POS That Speaks Your Language

For retailers, distributors, or pharmacies, Odoo POS is built to handle:

- Hindi or regional language receipts

- Barcode scanning with Indian code formats

- GST billing at POS with discounts and bundle schemes

- Offline sales syncing when internet is unstable

It’s especially handy for franchise stores, local kirana chains, and garment showrooms where speed, accuracy, and compliance all matter.

How It’s Working for Real Indian Businesses

Odoo isn’t just theory—it’s already helping businesses like yours:

🔸 A Jaipur-based marble exporter automated GST filing and now completes monthly returns in 30% of the earlier time.

🔸 A D2C skincare brand from Mumbai scaled their order volume 3x in 6 months by managing sales, stock, and shipping through a single Odoo dashboard.

🔸 A Pune auto parts factory replaced seven disconnected software tools with one Odoo instance—and finally got full visibility across departments.

These are not large corporations. They’re regular businesses who found clarity through integration.

How Odoo Stands Apart from Traditional Indian Tools

You’ve probably used or heard of Tally, Busy, Zoho, or Marg. While these tools work well in silos, here’s how Odoo compares:

Feature | Odoo ERP | Tally / Busy / Zoho |

GST + e-Invoicing | ✅ Built-In | ⚠️ Requires exports |

Multi-State Setup | ✅ Native | ❌ Workarounds needed |

Mobile App + Web Access | ✅ Seamless | ❌ Limited |

POS, CRM, Projects, HR | ✅ All-in-One | ❌ Separate tools |

Customization & Scalability | ✅ Flexible | ⚠️ Minimal |

If you’re just starting, you might not need it all. But when you're growing, fragmented systems slow you down.

What Local Partners Add to the Mix

One of the best things about Odoo is that it’s open source—but that means the implementation matters.

Trusted Indian Odoo partners help with:

- Plug-and-play GST & e-invoice modules

- State-wise tax setups for multi-GSTIN filing

- Vernacular UI for warehouse or retail users

- Dashboards in ₹, with region-specific KPIs

At Odoo Pundit, we’ve helped manufacturers, exporters, and even wellness brands move from chaotic systems to connected, compliant operations.

We don’t just set up the system, we adapt it to your business model.

Wrapping Up: Digitization Is No Longer Optional

Whether you're managing 10 people or 200, the pressure to digitize is real. But it doesn’t have to be overwhelming.

With a platform like Odoo, especially one that’s tailored for Indian business practices, you get:

- Better control over your operations

- Automatic compliance for taxes and reporting

- Freedom from scattered tools and last-minute panic

The best part? You can start small and scale as you grow.

Ready to Explore What Odoo Could Do for You?

If you’re wondering whether Odoo would actually fit your business, we’d love to talk.